Africa and Middle EastAllAllAllEuropeOngoingOngoingOngoingThe Americas

Dollar Diplomacy in Africa and Latin America

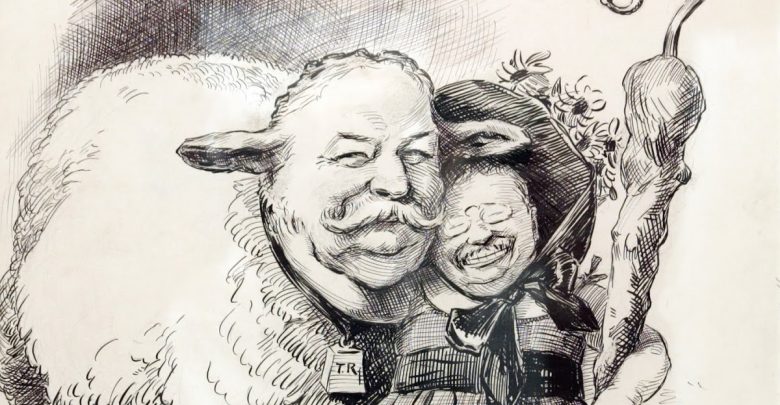

Dollar Diplomacy was the form of American foreign policy which furthered the country’s interests in Africa and Latin America through economic power under President Taft.

The United States’ foreign policy in the Latin America and East Asia through foreign loans was a legacy with reverberating effects. Under President Taft, the State Department was active in encouraging American bankers and industries to branch out for new economic opportunities abroad following Roosevelt’s Big Stick Diplomacy. Serving a dual purpose, this economic incentive allowed American markets to enter foreign territory, as well as encouraged local goodwill towards the United States with the promise of employment and an influx of stable currency. This effort was dubbed Dollar Diplomacy and speaks to the reverberating effects of American involvement all over the world.

President Roosevelt laid the foundation for Dollar Diplomacy with his Monroe Doctrine, which stated that any nation in the Western Hemisphere that was susceptible to political or financial instability was to be protected by the United States with the idea of mitigating European control in the region. Upon incumbency, Taft expanded the policy, which effectively adopted the protection of the Panama Canal. This allowed the United States to economically stabilize trade coming in to and out of America.

Dollar Diplomacy in Africa

Dollar diplomacy in Africa was specific to Liberia, which was given US loans for the first time in 1913. Liberian President Arthur Barclay was the first to introduce Liberia’s open door policy, allowing foreign aid into the country. In 1912, the country was facing a dire economic situation where there became a need to amortize all prior debts and financial obligations of the Liberian government.

Taking the United States’ loan in 1913 came with a price, effectively giving up part of its sovereignty. The newly appointed Financial Advisor to the Republic was selected by the United States to secure American interests in the country and Africa. Subsequently, the powers of the Minister of Treasury became limited.

Dollar Diplomacy in Latin America

The country of Honduras racked up huge debts to the British in the late 18th century. The United States saw this as an opportunity to quell any attempt at British invasion of the country. Taft sent in American bankers and investors to the country to restore the country’s fiscal order.

The Nicaraguan Revolution of 1909 allowed Americans to invest and support the newly established revolutionary government. While US Marines assisted the revolutionaries in securing their power as rulers of the government, staying in the country until 1925. American investors and bankers were given control of Nicaraguan finances, including paying national debts, collecting customs fares and returning the remainder to the newly installed government.

Who is the Next Dollar Diplomat?

Today, we can turn back to places like Libera, Cuba and Venezuela to see contemporary effects of Dollar Diplomacy. Earlier this year, the government of Liberia shot down accusations that the country would recognize Taiwanese autonomy and they hold strong to the One China Policy. The PRC regularly funds infrastructure in Liberia, and their diplomatic relations date back to 1977. China’s new practice of funding infrastructure and camaraderie with developing nations has been coined “Checkbook Diplomacy,” and encompasses China’s overarching strategy to dominate developing nations for better trade and economic policies for the country.